Table Of Content

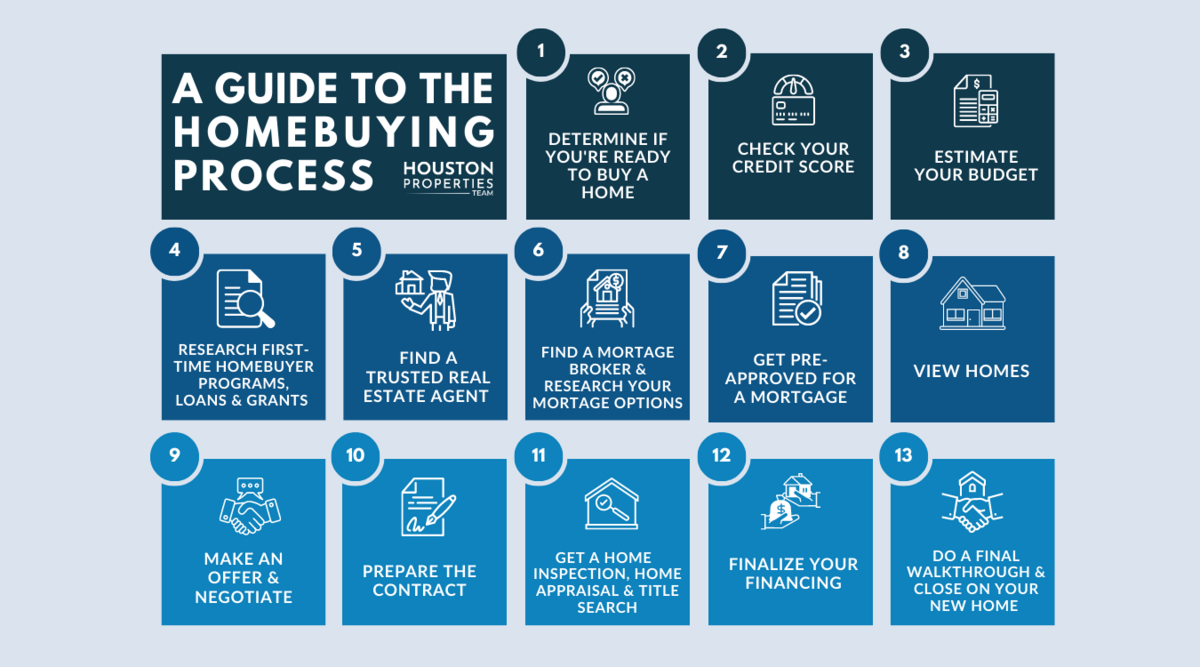

A higher credit score (and lower DTI) means better loan options with lower interest rates. Before you start shopping, it’s important to get an idea of how much a lender will give you to purchase your first home. In addition, many real estate agents will not spend time with clients who haven’t clarified how much they can afford to spend. When researching how to buy a house, you will want to get a mortgage pre-approval.

Financial requirements

If you prefer, you can speak directly with a lender or a mortgage broker to help you find and apply for a mortgage. They’ll be able to look at a variety of mortgage options for you and give you advice. The one for you will depend on your financial situation, plans, and the type of property you’re buying. With your list of requirements in hand, it’s time to contact estate agents, search for properties and arrange viewings.

Step 13: Close On Your New Home

While you might consider current mortgage rates ideal, you might benefit from waiting to build credit or saving for a bigger down payment. Speak with a lender or real estate agent before making the decision to buy this year or wait. Home buyers should also include an appraisal contingency in their offer. Appraisal contingencies are often drawn up to allow buyers to back out of a purchase (or negotiate a lower price) without losing their earnest money deposit if the home appraises for less than the offer amount. As with inspection contingencies, appraisal contingencies vary, so make sure you understand the nature of your agreement. Multiple people are involved when getting a mortgage and buying a house.

Restrictive Covenants: How They Affect Your Property

If there are any problems, your agent can help you get them fixed. We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Moving Checklist: Everything You Need to Know for a Smooth Move

This requires additional documentation, which is necessary to assure the lender you can handle the loan payments. You’ll want to have enough for closing costs and a down payment. You may also need to have cash reserves to help cover your mortgage in case of emergencies.

Make an offer

This not only gives you a firm budget for house hunting, but also lets sellers know you’re qualified to make an offer. The first step to buying a home is making sure you can afford the mortgage. A licensed appraiser will determine the home’s market value based on comparable recent sales of homes in the neighborhood.

Chase Security Center

'Have a Plan B': Realtors of color offer advice on how to navigate the home-buying process - Sahan Journal

'Have a Plan B': Realtors of color offer advice on how to navigate the home-buying process.

Posted: Tue, 20 Feb 2024 08:00:00 GMT [source]

Shop, bundle, and save on insurance coverage for home, auto, life, and more. Now that you have a better understanding of the home buying process, let’s take a look at a few frequently asked questions about home buying. Buying a home with no money down is possible, but most homeowners need to have some cash on hand for a down payment. They’ll also want to see a work history (usually about 2 years) to make sure your income source is stable and reliable. Even though you own a home, you should do your best to save the maximum in your retirement savings accounts every year. Although it may seem hard to believe for anyone who has observed the fortunes that some people made during the housing bubble, you won’t necessarily make a killing when you sell your house.

Probate sale FAQs

Morgan offers investment education, expertise and a range of tools to help you reach your goals. Morgan Wealth Management Branch or check out our latest online investing offers, promotions, and coupons. While many estates, with or without wills, go through the probate process, there are some exceptions. The rules vary based on where you live, the size of the estate and the nature of the will, so it’s best to consult with your local real estate professionals or attorney for some insight on your specific situation. Mr. Bragg is arguing that the cover-up cheated voters of the chance to fully assess Mr. Trump’s candidacy.

Perhaps you want a broken window fixed or a handrail replaced—just make sure you know what repairs you’re willing to take on after the home is fully yours. From here, it may only take a few hours to discuss the terms of your offer with your real estate agent before it’s submitted. But, it’s after you submit the offer that the real nail-biting begins. Sellers aren’t required to respond within a specific period of time, but most will either accept, reject, or counter your offer within 24 to 48 hours.

580 is the minimum credit score to qualify with a 3.5% down payment. You need to know exactly how much you’re spending every month—and where it’s going. This calculation will tell you how much you can allocate to a mortgage payment.

Programs, rates, terms and conditions are subject to change without notice. Emily is part of the content marketing team and enjoys writing about real estate trends and home improvement. Her dream home would be a charming Tudor-style house with large windows to let in lots of natural light. This is when you can verify that the condition of the house hasn’t changed and that all updates and repairs have been made. The final walk-through usually takes place 24 hours before the scheduled closing day. Buying a new home is a complex undertaking, even if you’ve been through it before.

If you’re on a budget, look for homes whose full potential has yet to be realized. Even if you can’t afford to replace the hideous wallpaper in the bathroom now, you may be willing to live with it for a while in exchange for getting into a place that you can afford. If the home meets your needs in terms of the big things that are difficult to change, such as location and size, then don’t let physical imperfections turn you away. First-time homebuyers should look for a house that they can add value to, as this ensures a bump in equity to help them up the property ladder.

Another important cost to factor into your budget is closing costs, which are typically 2%-5% of the purchase price.After you determine how much house you can afford, you should begin saving for a down payment. The down payment is usually 20% of the home’s final sale price, but if you decide to put less money down you may need to pay private mortgage insurance (PMI). Some mortgages for first time homebuyers may not require the full 20% down. In fact, there are little to no down payment home loans out there for those who qualify, such as the VA loan for those that served in the armed forces. Most offers also contain an earnest money deposit, typically 1% – 3% of the purchase price, which shows the seller you’re serious about purchasing.

Don’t even consider buying a home before you have an emergency savings account with three to six months of living expenses. When you buy a home, there will be considerable upfront costs, including the down payment and closing costs. You need money put away not only for those costs but also for your emergency fund. Along with your offer, you’ll be required to provide an earnest money deposit, also known as an escrow deposit.

No comments:

Post a Comment